In one of the first major trades of this season’s deadlines moves, the Portland Trailblazers traded CJ McCollum, Larry Nance, and Tony Snell to the Pelicans for Josh Hart, Tomas Satoransky, Nickeil Walker-Alexander, Didi Louzada, a 2022 protected 1st round pick, and two 2nd round picks. There is a variety of opinions of why each teams did this trade, who got the better long term haul, and obviously the shadow of Dame looms over every move the Trailblazers make. Let’s first analyze this trade first through some analytics, and then analyze how this trade worked through the CBA and how it sets up both teams going into the offseason.

Analytics

Both Josh Hart and CJ McCollum this season are almost at the same SQ PPP and Good Possession Rate, with McCollum having 6% less bad possessions than Hart. So let’s see why this trade makes sense for both teams if they have almost identical efficiency and possession rates.

Obviously the player that sticks out the most in this trade is CJ McCollum, who has been with Portland for 9 seasons. This season he missed some time due to a collapsed lung, but ever since he returned in 12 games he is at a 1.000 PPP. Let’s take a look at his Shot Quality Profile to see what the Trailblazers are losing and what the Pelicans are gaining. McCollum has always graded out really well in the Spacing Metric and Creating his Own Shot, as well as his efficiency from the 3pt line and the Mid-Range. Something that gets lost when talking about his game is he is a really good secondary playmaker. This season he is in the 91st percentile in Passing, averaging 4.6 SQ assists and 9.5 SQ Points per game. He averages 9.2 Assist Opportunities a game, and his Adjusted Assists per game is 5.9. These numbers would put McCollum 2nd on the Pelicans Roster in regards to playmaking metrics, something that will help lighten the playmaking load off of Deonte’ Graham and Brandon Ingram.

From the Pelicans’ perspective, they are obviously try to build a competitive team now so that when Zion does return to the court, they can hit the ground running and continue to work on convincing Zion to stay in New Orleans. The first aspect this trade immediately addresses for them is their lack of 3pt shooting. As a team they ranked 23rd in 3pt attempts, 26th in 3pt efficiency, 28th in C&S 3’s SQ PPP, and dead last in Off the Dribble 3pt SQ PPP. If you look at McCollum’s numbers, his long midrange SQ PPP at 1.02 is almost as good of a shot as the Pelicans’ average C&s 3 at 1.04 SQ PPP. CJ this season in C&S 3’s is at a 1.30 SQ PPP (93rd Percentile), and his Off the Dribble 3 is at a 1.15 SQ PPP (92nd Percentile). While the Trailblazers grades out as having the 2nd best spacing in the league at 97%, the Pelicans are dead last in the league at 3%. This trade helps address some of the worst weaknesses the Pelicans’ have on the offensive side of the ball, which should have a positive impact on Ingram, Graham, and eventually Zion when he gets on the court. Though he is getting older, McCollum is also no slouch on the defensive end. He is averaging almost the same amount of deflections, steals, and contested shots as Josh Hart.

Josh Hart has really grown and developed since being the last pick in the 1st round of the 2017 NBA draft. He was a good role player in Los Angeles before being traded to the Pelicans in the Anthony Davis trade, and has gotten better every season since that trade. The thing that sticks out to me immediately when looking at his Shot Quality profile is his frequency and efficiency at attacking the rim. When driving to the rim his SQ PPP is at 1.37 (89th percentile), while his C&S 3pt SQ PPP is at a 1.03 (47th Percentile) and is Off the Dribble 3pt SQ PPP is at a 0.87 (50th Percentile). With Zion living at the rim last season, substituting a guard who also wants to get to the rim with a guard who spaces the floor at an elite level will pay big dividends down the line. While Hart has been more active as being a playmaker by the raw numbers, his assists per game at 4.1 drops down to 3.1 SQ assists per game. Still a good secondary playmaker for the Blazers along with a developing one in Nickeil Alexander-Walker, but not at the level McCollum is right now. From my perspective, the Trailblazers in executing this trade were primarily motivated in more flexibility and more assets for the coming offseason, while still adding a good but younger and cheaper player to replace McCollum.

CBA Implications

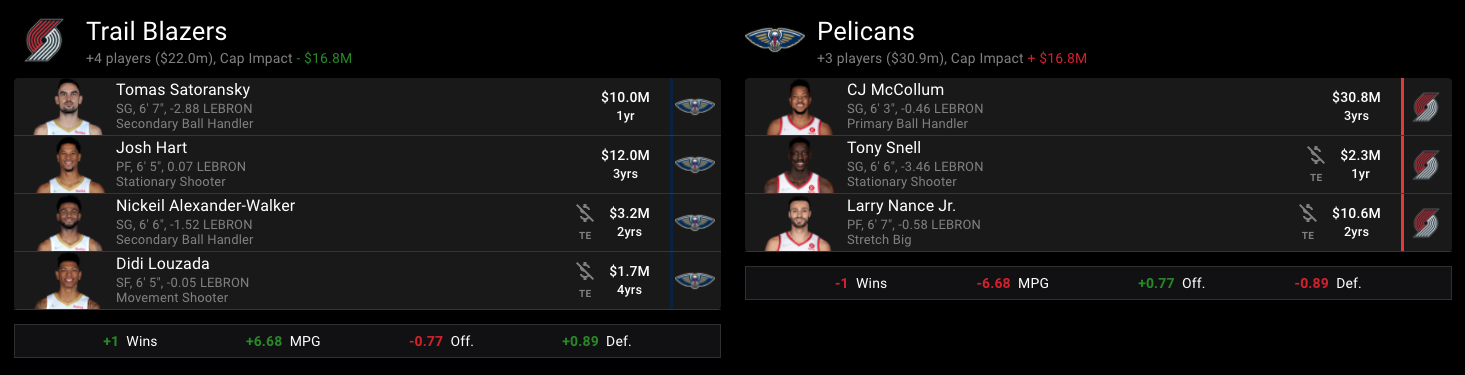

This season CJ McCollum is making about $30.9 millions dollars and he has, including this season, 3 years left on his contract. This means that the Pelicans would need to send out around $24.6 million to be able to take on McCollum’s contract according to the CBA. Hart is making $12 million this season with $0 guaranteed money after, Satoransky is making $10 million on an expiring contract, and Alexander-Walker is making $3.3 million this season. This would allow the Pelicans to financially be able to make the trade. The Pelicans acquire Larry Nance through their existing $17.1 million traded player exception (TPE) that came from the Steven Adams Trade, and they will have roughly $6.4 million left over from the exception. Portland creates a $20.8 million TPE and can now be projected to have $30+ million in cap room this offseason to go and try and take a major swing to get more help for Dame. The Trailblazers will need to waive an existing player on the roster to execute the trade due to the roster limit and number of incoming players.

Future Outlook

For the Pelicans, they desperately needed to find a great player who could space the floor to help and open up the paint for Zion when he gets back on the court. The Pelicans’ Cap Sheet didn’t have any bad contracts on the books, so they had the flexibility to take on McCollum’s contract and could sign an extension with him this offseason if he is interested. They were also able to get a productive player in Nance and used an expiring asset to facilitate the trade.

For the Blazers, it seems obvious that with this trade and the Powell/Covington trade that they are punting on this season and will now be looking to develop their younger guys for next season. They added to their trade assets with both trades and created flexibility and cap room to go after the top free agents on the market, as well as explore major deals with other teams. Before both of these trades, they were stuck with a team that had a very limited ceiling and a very good backcourt who could never breakthrough to an NBA Finals. Now they have a lot more avenues to improve this team’s ceiling with Dame, the only question will be if Joe Cronin, the interim GM, will be able to stick the landing after this major roster shakeup.